Acquisitions

The Ventoaccess Partners acquisitions team has an in-depth knowledge of apartment markets throughout the country. This gives us the ability to underwrite and ultimately close acquisitions in a timely and diligent manner. We pursue well-located acquisitions throughout the Midwest, Southeast and Southwest. Generally, we target garden style or mid-rise communities with a minimum of 100 units.

Population

Properties

House

Branches

Keys to Our Competitive Edge

We seize opportunities

not afforded to others through an earned reputation for closing deals under contract.

We are committed to creating wealth

through long-term ownership — typically over a 10-12-year period — rather than attempting to time short-term markets.

We offer real estate, agro-products and oil & gas investment funds

which allows us to acquire properties with hidden value when opportunities arise.

Highly Selective Acquisition Process

-

Opportunity Assessment

Each year, our seasoned acquisitions team reviews more than 300 potential multifamily opportunities, sourced through a national network of brokers and owners.

Underwriting

Deals are then examined through a disciplined underwriting process, of which roughly 20 percent are presented to senior management for further consideration.

Management Review

Select apartment communities undergo a rigorous review process that includes feedback from our in-house operations and asset management teams to determine which opportunities meet the Ventoaccess Partners standards.

Ventoaccess Partners provides a letter of intent to purchase if our team agrees that the deal presents opportunities to create value for our residents and for our investors.

Operating Strategy

Experience, quality, and results.

After closing on a deal, our asset management, capital improvement and property management teams transition the new asset into the Ventoaccess Partners portfolio. Our proven process includes making value-add improvements and implementing our best-in-class management.

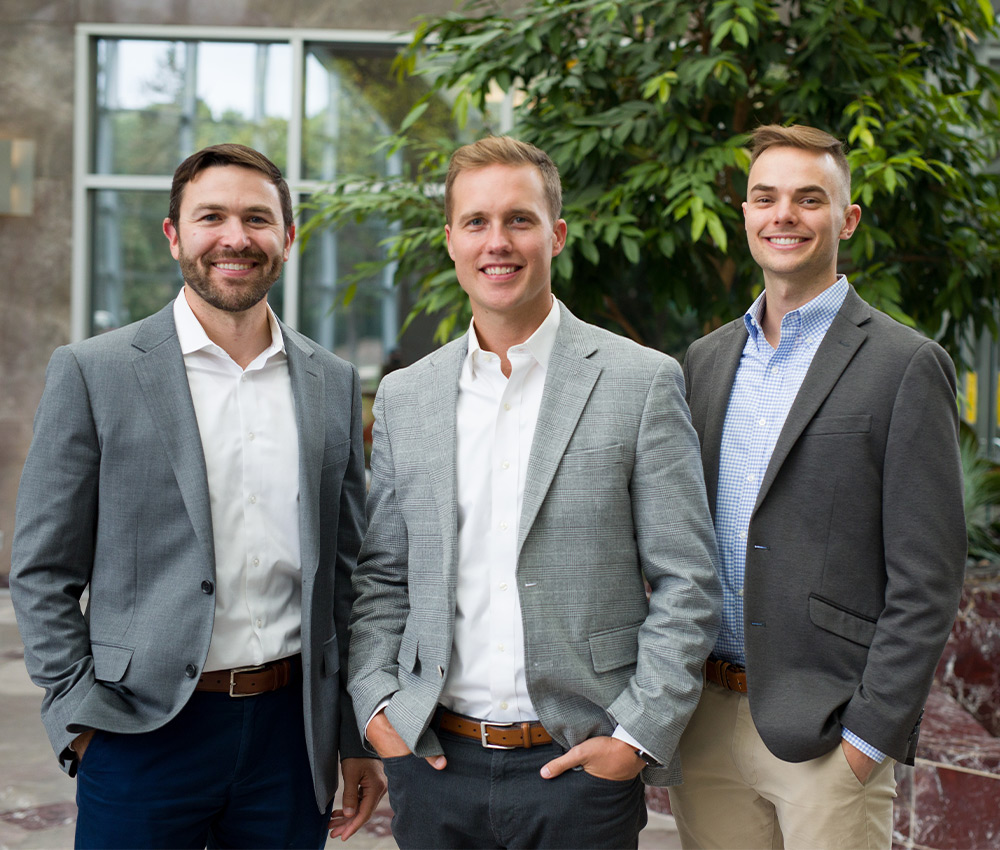

Acquisitions Team

Our acquisitions team, led by Chief Investment Officer Matt Fransen, strategically identifies, reviews, and pursues acquisition opportunities that align with Ventoaccess Partners’ diligent investment strategy.

Interested in Investing?

To begin investing with us, please contact our investor relations team or visit our investments website for more information.